How do you use the IRR function in Excel?

To instruct the Excel program to calculate IRR, type in the function command “=IRR(A1:A4)” into the A5 cell directly under all the values.

When you hit the enter key, the IRR value, 8.2%, should be displayed in that cell.

Why is IRR not working in Excel?

The XIRR function calculates in the internal rate of return for series of cash flows that occur at irregular intervals. To calculate the internal rate of return for a series of regular, periodic cash flows, use the IRR function. Payments are expressed as negative values and income as positive values.

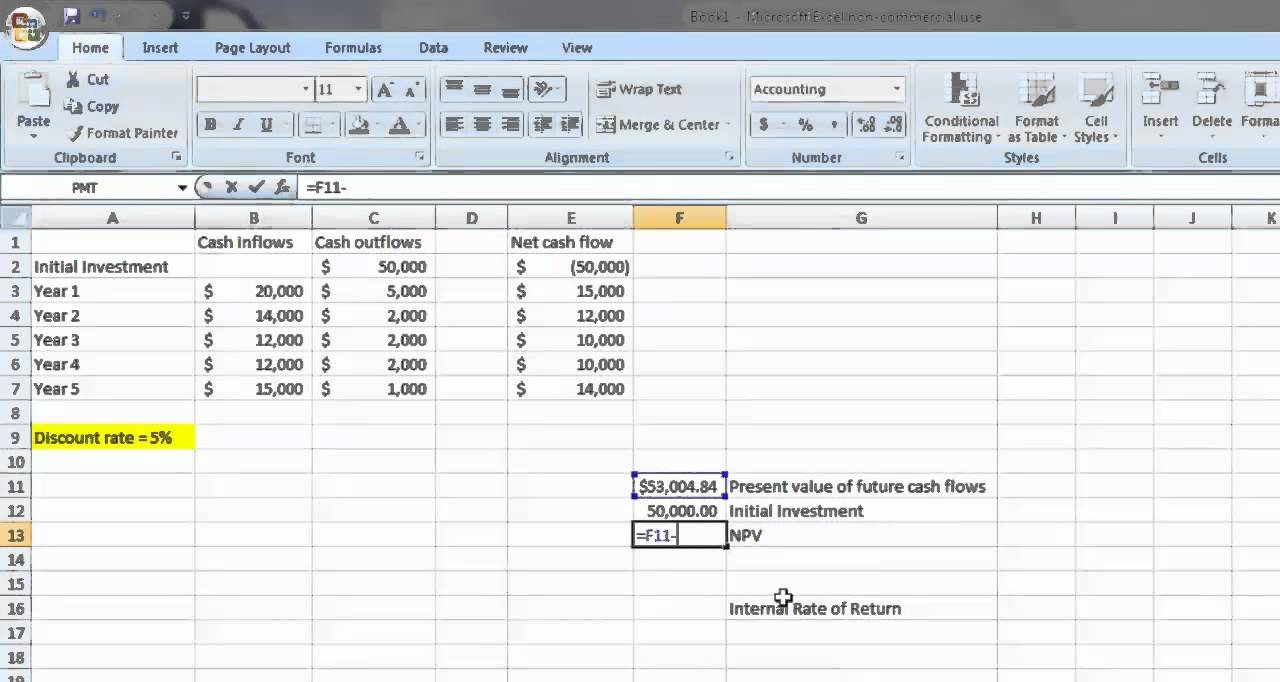

I want to use the IRR function in Excel; however, my inputs exists in a non-contiguous range. For example, I want to know the return of an asset over time (each row is a time period). Column A has the cost (cash outflow) of owning the asset/ Column B is the price of the asset (cash inflow if liquidated). Excel allows a user to get an internal rate of return and a net present value of an investment using the NPV and IRR functions. This step by step tutorial will assist all levels of Excel users in calculating NPV and IRR Excel. The result of the NPV and IRR functions.

The Problem: Even if net cashflows are negative, Excel can produce a positive IRR. For example, if cashflows at the beginning of a project are small and positive, and at the end of the project are large and negative, the IRR will necessarily need to be high to reduce the net present value of the later cashflows.

What is the formula for IRR?

To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate (r), which is the IRR. Because of the nature of the formula, however, IRR cannot be calculated analytically and must instead be calculated either through trial-and-error or using software programmed to calculate IRR.

How do you calculate IRR and NPV in Excel?

Using Excel to calculate NPV and IRR –

How do you calculate IRR quickly?

To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate (r), which is the IRR. Because of the nature of the formula, however, IRR cannot be calculated analytically and must instead be calculated either through trial-and-error or using software programmed to calculate IRR.

What is a good IRR?

Typically expressed in a percent range (i.e. 12%-15%), the IRR is the annualized rate of earnings on an investment. A less shrewd investor would be satisfied by following the general rule of thumb that the higher the IRR, the higher the return; the lower the IRR the lower the risk.

Why Is My Irr Not Working In Excel

Can you have an IRR greater than 100?

Keep in mind that an IRR greater than 100% is possible. Extra credit if you can also correctly handle input that produces negative rates, disregarding the fact that they make no sense. You pick an IRR and check to see if the NPV is zero, or very close to it. When it is, you found the right IRR.

How does Excel IRR work?

The Microsoft Excel IRR function returns the internal rate of return for a series of cash flows. The cash flows must occur at regular intervals, but do not have to be the same amounts for each interval. The IRR function is a built-in function in Excel that is categorized as a Financial Function.

Can IRR be positive if NPV negative?

If your IRR < Cost of Capital, you still have positive IRR but negative NPV. Instead, if your cost of capital is 15%, then your IRR will be 10% but NPV shall be negative. So, you can have positive IRR despite negative NPV.

How do you calculate IRR on a calculator?

Internal Rate of Return IRR with TI 84 –

Irr Calculator Excel

What is the difference between IRR and ROI?

IRR vs ROI Key Differences

One of the key differences between ROI vs IRR is the time period for which they are used for calculating the performance of investments. IRR is used to calculate the annual growth rate of the investment made. Whereas, ROI doesn’t take future value of money while doing the calculations.

How do I calculate IRR using Excel?

To instruct the Excel program to calculate IRR, type in the function command “=IRR(A1:A4)” into the A5 cell directly under all the values. When you hit the enter key, the IRR value, 8.2%, should be displayed in that cell.

How do you calculate multiple IRR?

Cash flow with multiple IRRs –

How do you calculate NPV and IRR?

NPV and IRR explained –

What is NPV and IRR?

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Excel IRR Function and Other Ways to Calculate IRR in Excel

Download Excel WorkbookDownload the workbook

The internal rate of return (IRR) is a common source of error in a financial model. This tutorial covers how to calculate an IRR in Excel, and assumes that the reader is already familiar with the mathematical concept of the IRR.

This tutorial discusses methods to calculate IRR using a trial and error method or using a 1-Dimension data table. It also explains how to calculate IRR using NPV or XIRR in Excel.

Key Learnings

- What is the best way to calculate the IRR of a set of cash flows?

- Calculate IRR using the trial and error method

- Unsing a 1-Dimension data table to spot the root

- Using IRR() in Excel

- Using XIRR() in Excel

- Common applications of IRR

The internal rate of return (IRR) is a common source of error in a financial model. This tutorial covers how to calculate an IRR in Excel, and assumes that the reader is already familiar with the mathematical concept of the IRR.

The IRR can be defined as a discount rate which, when applied to a series of cash flows, generates a nil net present value (NPV). There may be more than one IRR in certain situations; additionally, Excel makes this calculation deceptively simple, at the risk of errors.

The NPV is the discounted value of a stream of cash flows generated from a project or investment. IRR computes the break even rate of return for which the NPV equals to zero. It is an indicator of the efficiency or quality of an investment, as opposed to the NPV which indicates value or magnitude.

The IRR is the annualised effective compounded return rate, denoted by ‘r’. Mathematically, it can be formulated as:

What is the best way to calculate the IRR of a set of cash flows?

In this tutorial we will discuss the possible methods to calculate the IRR:

How Does Irr Work In Excel

- Using a trial and error method (to assist understanding)

- Using a 1-dimension data table

- Calculating IRR using Excel function NPV()

- Calculating IRR using XIRR

The downloadable Excel workbook above has been prepared to demonstrate the IRR calculation. For ease of reference, we recommend you download the workbook while reading this tutorial.

Trial and error method for IRR calculations in Excel

IRR is the discount rate for which NPV equals zero, and could be calculated by a trial and error process.

- NPV(IRR(…), …) = 0

- XNPV(XIRR(…), …) = 0

The trial and error process is as follows:

- Start with a guess of the discount rate ‘r’

- Calculate NPV using the ‘r’ – refer to our tutorials on how to calculate an NPV with or without Excel formulae

- If the NPV is close to zero, then ‘r’ is the IRR

- If the NPV is positive, increase ‘r’

- If the NPV is negative, decrease ‘r’

- Continue the process until NPV reaches zero

Using the example in the workbook:

- Refer to screenshot 1: The NPV calculated at a discount rate of 10% is $19.31 million, hence we know that the IRR should be greater than 10%

- Refer to screenshot 2: Let us now try ‘r’ of 18%. The NPV is -$0.87 million. It is negative, but the NPV is closer to zero this time.

- Therefore, we could guess that the IRR should be slightly lower than 18%.

- The trial and error process can be more tedious than calculating an NPV itself.

- Next, we will show you the approach of guessing the IRR with the help of a 1-dimension data table.

Using a 1-dimension data table to spot the root

We recommended presenting NPV at various discount rates using a quick 1-dimension data table, with discount rates as the vertical parameter as shown in screenshot 3.

Let us plot the above data table in a chart – see screenshot 4. It becomes clear that the IRR is between 17.50% and 18.00%. To be precise, the IRR is 17.53%, which we could get using the Excel function.

Using IRR() in Excel

IRR() syntax:

IRR(CF1, CF2, …)

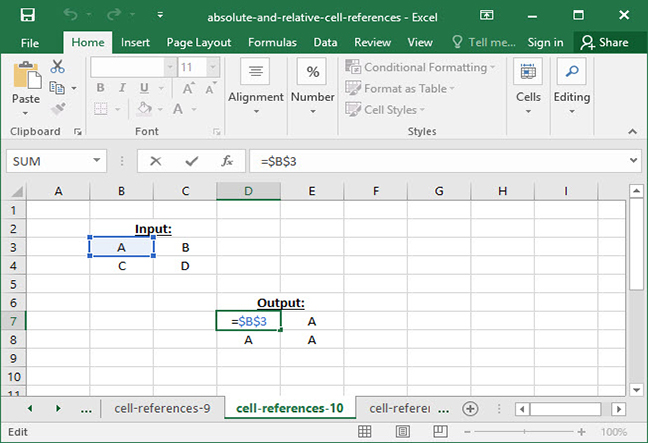

We could calculate IRR using Excel function IRR(), but similar to NPV(), it has some limitations:

- The cash flows (CFi) must be equally spaced in time and occur at the end of each period

- The CFi must be entered in the correct sequence

Using XIRR() function In Excel

Due to its limitation, the IRR function (without the X) is best avoided. The more robust function would be XIRR(). It returns the internal rate of return for a schedule of cash flows that is not necessarily periodic.

XIRR() is an added-in function in Excel and the syntax is: XIRR(CFi, dates)

As demonstrated in screenshot 5, the calculated IRR is 17.53%. We could double check the calculation by feeding the IRR back into the NPV calculation as a discount rate, for which NPV equals zero.

Common Applications of IRR

Capital budgeting: Investment decision tool

IRR is a metric to decide whether a single project is worth investing in. Theoretically, a simple decision making benchmark could be set to accept a project if the IRR exceeds the cost of capital, and rejected if this IRR is less than the cost of capital.

You should be aware of the limitation of the IRR, such as a project with multiple IRRs or no IRR. In addition, IRR neglects the size of the project, and assumes that cash flows are reinvested at a constant rate.

Tariff optimisation

IRR is commonly used in optimising the toll/tariff regime in project finance transactions, such as in public, private partnerships (PPP) schemes. This could be done during the bidding process based on the expected IRR. Alternatively, a tariff could be adjusted in order to provide a minimum IRR threshold for the concessionaire.

Corality Academy: Corality Financial Modelling Campus

There are numerous other tutorials and free resources related to financial modelling in the Corality Financial Modelling Campus.

Some of the more popular courses that relate to this topic include: